The $826 Billion Game: Navigating Investment Opportunities in Sports

The sports industry is experiencing an unprecedented influx of institutional investors, private equity, and venture capital, driving a major shift in how sports franchises are financed and operated. JPMorgan Chase recently formed a dedicated sports investment division led by Eric Menell and Gian Piero Sammartano, highlighting the growing attraction from institutional investors. Seasoned investment firm Sixth Street Partners recently announced a sports-focused fund and has already invested in Real Madrid, Barcelona, and Bay FC. Another major player is Arctos Partners, which has over $7 billion invested primarily in sports teams alone.

Private equity firms are becoming increasingly prevalent in the ownership structures of sports teams across major leagues such as the NBA, NHL, MLB, and MLS. This shift is driven by the soaring valuations of these teams, which now see NBA franchises averaging $4 billion in worth, MLB teams at $2.64 billion, and NHL teams at $1.31 billion (Sportico). The leagues have embraced private equity due to stringent ownership regulations that ensure control remains within the league’s framework. The remarkable growth in team values has made sports franchises a highly attractive investment, outpacing the stock market’s growth over the past thirty years. DBRS Morningstar found that while the S&P 500 rose by 317% between 2004 and 2022, NBA’s valuation rose 1,079% over the same time period, and MLB’s valuation rose by 702%. For private equity investors, the appeal lies not only in the high returns but also in the diversification benefits, as sports assets typically do not correlate with other types of investments.

Rising valuations and growing opportunities for media rights and sponsorships make professional sports teams an attractive bet, with investments in 63 North American teams totaling $243.8 billion. The NBA leads with 20 teams connected to private equity valued at $74.2 billion. Despite constraints on controlling interests, firms like Arctos Partners have achieved significant returns, with Fund I delivering an 86.7% net IRR by September 2023.

However, alongside these opportunities come significant challenges and risks. This convergence of industry disruption and new avenues for investing presents unique prospects for private equity and venture capital firms. We’re already seeing in real-time the remarkable shifts in this space. Here are some compelling developments worth considering.

Disruption in the Sports Industry

The sports industry is experiencing significant disruption, driven by technological advancements, globalization, and shifting consumer behaviors. The global sports market is projected to reach $826 billion by 2030, reflecting robust growth across various segments (Yahoo Finance). Additionally, the global sports betting market is expected to expand from $83.65 billion in 2022 to $182.12 billion by 2030, driven by technological advancements and increasing legalization, with a compound annual growth rate (CAGR) of 10.3% (Grand View Research). The sports tech market is projected to grow to $103 billion by 2030. Key factors driving this disruption include:

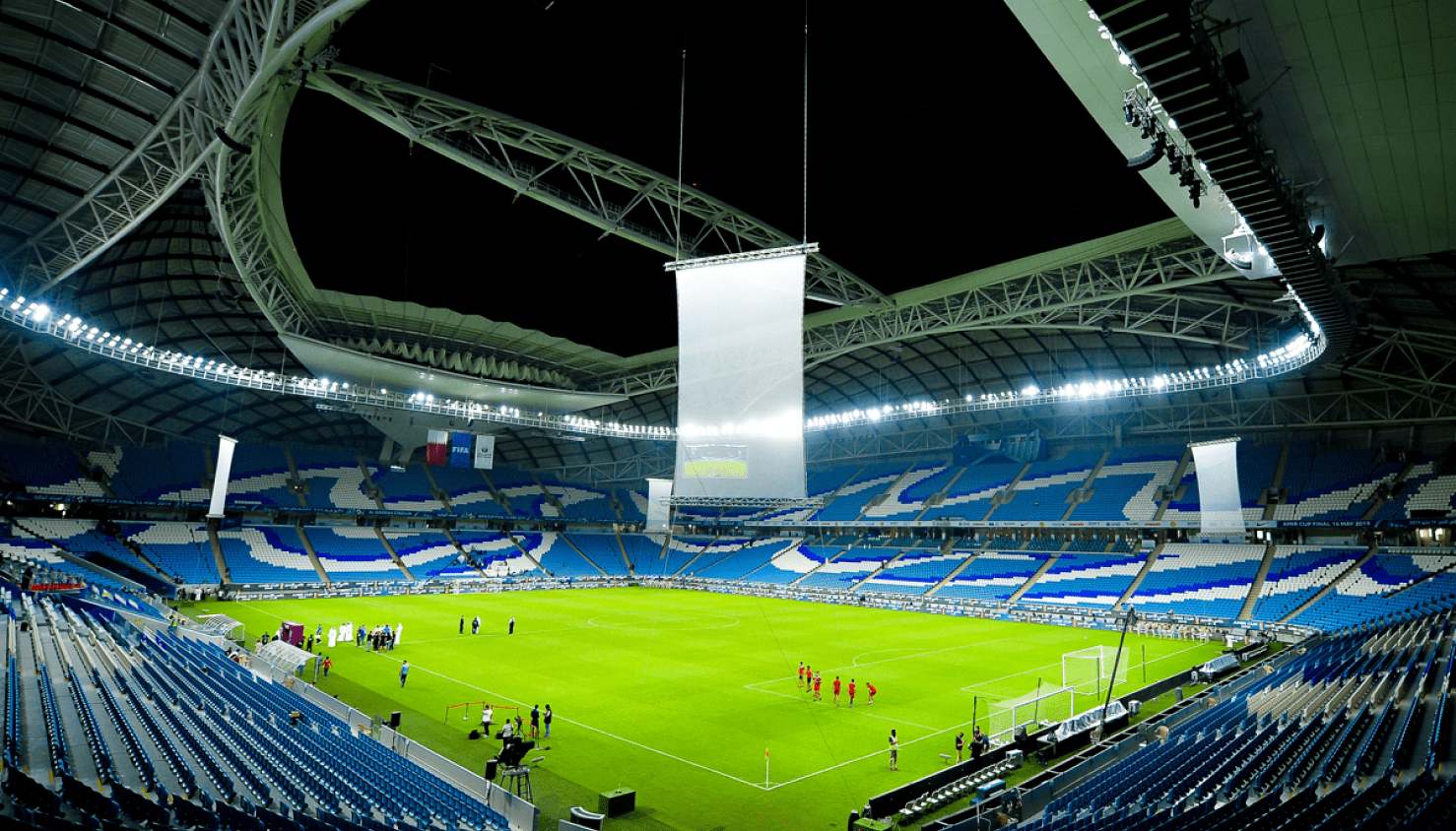

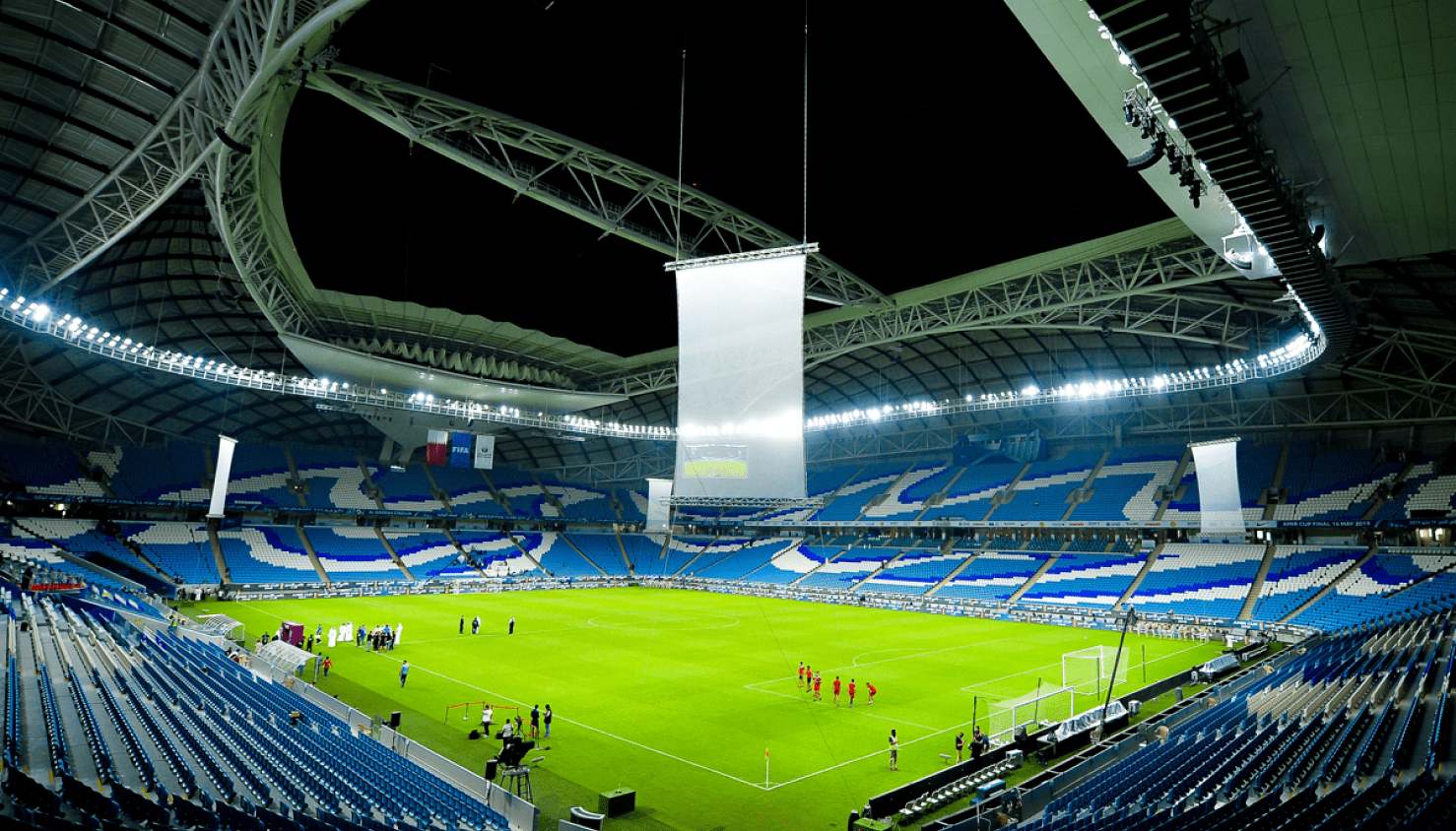

- Globalization: The expansion of sports into new markets, particularly in Asia and the Middle East, is creating vast new audiences and revenue streams. The NBA’s strategic push into China, for instance, has resulted in a massive fan base and significant revenues from broadcasting deals and merchandise sales. In the Middle East, the NBA has partnered with local entities to host games and establish academies, broadening its reach and influence (BCW) (SportsPro Media).

- Shifts in Consumer Behavior: Younger audiences are consuming sports differently, preferring digital and interactive experiences over traditional broadcasts. This includes the rising popularity of women’s sports, eSports, and digital streaming. Platforms like Twitch have transformed how fans watch and interact with sports content, driving significant viewership growth in eSports and other digital formats (Deloitte United States) (BCW).

- Technological Advancements: Innovations such as augmented reality (AR), virtual reality (VR), and data analytics are revolutionizing fan engagement and team performance. For example, AR applications now allow fans to experience live games with interactive features like player stats and virtual courtside seats, significantly enhancing the viewer experience (BCW).

High Growth Potential for PE and VC Firms

These disruptions are creating highly lucrative opportunities for PE and VC firms. The sports industry continues to attract significant investments for a few key reasons:

- Sustained Revenue Growth: Sports franchises and related businesses have historically delivered strong returns. The increasing value of media rights deals and the global appeal of sports ensure steady revenue streams. For instance, the average value of an NFL team has surged to $5.1 billion, driven by lucrative broadcasting agreements and sponsorship deals (SportsPro Media).

- Diverse Investment Opportunities: The sports industry offers a range of investment avenues, from owning teams and leagues to investing in sports tech startups and infrastructure projects. This diversity allows investors to spread their risk and tap into various growth areas within the industry (SportsPro Media) (Sportcal).

- Expanding Market Segments: Segments like women’s sports and eSports are experiencing rapid growth, attracting significant investment. GroupM’s commitment to double media investment in women’s sports by 2025 underscores the potential in this segment (Sportcal). Similarly, the sports betting market, expected to grow at a CAGR of 10.3% from 2022 to 2030, offers substantial opportunities for investors (Grand View Research). Major financial institutions are increasingly recognizing the potential in sports investments. For example, JPMorgan Chase recently formed a new sports investment division to capitalize on the growing market (Profluence). This move signals strong institutional confidence in the sector’s growth prospects. Additionally, notable PE firms like Sixth Street, Bluestone Equity Partners, and Avenue Capital have launched dedicated sports funds, reflecting a strategic shift towards sports investments (PE Hub) (Private Equity Insights).

A Global Perspective

From a global standpoint, the sports industry is thriving across multiple regions and leagues:

European Soccer: Clubs like Manchester United and Real Madrid are expanding their global footprint through strategic partnerships and sponsorships. Manchester United’s landmark deal with Chinese technology giant Alibaba enhances digital fan engagement in Asia. Real Madrid’s 5-year deal with the Middle Eastern airline Emirates leverages the airline’s extensive network to promote the club worldwide. The Soccer Champions Tour 2024 will feature top teams like AC Milan, Barcelona, Chelsea, Manchester City, and Real Madrid playing in various US cities, solidifying the presence of European soccer in North America.

Middle East NBA Expansion: The NBA’s activities in the Middle East, including preseason games and the establishment of basketball academies, are significantly expanding the league’s presence. This initiative not only builds a fan base but also attracts local sponsorship and media deals. We can expect more collaborations and expansion projects as the NBA aims to solidify its footprint in this emerging market.

China’s Basketball Market: The NBA’s long-term engagement in China has seen immense success. Partnerships with Chinese tech firms and broadcasting deals with platforms like Tencent have opened massive revenue streams, making China one of the NBA’s most lucrative markets. Expect to see continued growth in partnerships and digital engagement as the NBA leverages China’s massive consumer base (SF Chronicle).

NFL Valuations and Policy Shifts: In 2023, Josh Harris led a group that paid a record $6.05 billion for the Washington Commanders, highlighting the rising valuations of NFL teams. The challenge of raising such substantial capital has prompted the NFL to reconsider its stance on private equity investments. NFL Commissioner Roger Goodell indicated potential policy changes by the end of the year to address this growing interest.

While the opportunities in sports investments are substantial, they come with inherent risks and challenges:

Opportunities:

- Emerging Markets: Investing in emerging markets like Asia and Africa can yield high returns as these regions experience rapid growth in sports viewership and participation. The rising middle class in these regions is driving demand for premium sports content and experiences, creating new revenue opportunities. Additionally, the increasing digital penetration in these markets facilitates access to sports content, thereby expanding the potential audience base (BCW) (SportsPro Media).

- Growing Media Rights: The increasing value of media rights is driving substantial revenue growth in the sports industry. Recent multi-year media deals highlight this trend:

- The NFL secured an 11-year media rights agreement with major broadcasters including ESPN, CBS, Fox, and NBC, valued at over $100 billion.

- The NBA deal with ESPN totaling $24 billion will come to an end after the 2024-2025 season, with a new media rights agreement approaching $6 billion annually as the league aims to increase its number of media partners (Forbes).

- The English Premier League signed a six-year extension with NBC Sports worth approximately $2 billion, granting exclusive broadcast rights in the US (NBCSports).

Dangers:

- Market Volatility: Economic downturns and geopolitical tensions can significantly impact sports revenues, particularly in emerging markets. For instance, the recent economic slowdown in China has led to reduced consumer spending, including on sports and entertainment. According to the World Economic Forum, global economic growth is expected to decelerate to 2.6% next year.

- Geopolitical tensions, such as those in the Middle East and the ongoing war in Ukraine, further exacerbate market volatility. These tensions can lead to increased energy prices, disrupted supply chains, and reduced consumer confidence, all of which can negatively affect the sports industry. Investors need to be aware of these broader economic contexts and their potential impact on the sports sector. Diversification and investing in well-established franchises with strong revenue streams can help mitigate these risks (WEF).

- Regulatory Risks: Regulatory risks remain a significant challenge for investors in the sports industry. For example, the European Court of Justice (ECJ) ruled that UEFA and FIFA’s rules preventing new competitions like the ESL from being established were unlawful under European law. A Spanish court recently ordered FIFA and UEFA to halt opposition to the ESL ruling that these organizations engaged in anti-competitive behavior and abused their dominant position by preventing clubs from participating in the proposed new competition. This ruling opens renewed discussions about alternative league structures (ESPN). Leagues have also implemented stringent controls around private equity ownership to mitigate regulatory risks. No PE firm is allowed to be a controlling owner of any North American major league franchise, and in some cases, they are not even allowed to vote. Leagues require transparency regarding every investor in the PE fund, allowing them to veto any undesirable deals. Additionally, the sale of a PE firm’s ownership stake usually needs league approval (Sportico). The regulatory landscape across the board remains complex and can impact investment decisions.

Challenges:

- Valuation Accuracy: Accurately valuing sports assets can be complex due to fluctuating team performance and changing market conditions. The recent debate over the valuation of sports franchises like the Dallas Cowboys illustrates this challenge. Some industry experts argue that the Cowboys’ $9 billion valuation is inflated due to brand value and potential future earnings, while others point to the franchise’s consistent financial performance and market dominance as justifying the high valuation. This debate underscores the complexities involved in sports asset valuation and the differing perspectives on future profitability (Sportcal).

- Management and Control: PE and VC firms often face challenges in managing sports assets effectively, balancing profitability with the unique cultural aspects of sports organizations. The example of private equity’s involvement in Formula 1 shows how management complexities can arise, particularly in balancing commercial interests with the sport’s traditional values and fan expectations (SportsPro Media). To navigate these challenges, investors should prioritize strong governance structures and align management strategies with the cultural and operational realities of sports organizations.

New Shifts in Policy and Parameters

Recent shifts in policy and regulatory parameters are also influencing the investment landscape. The ongoing movement around opening up ownership rules in leagues like the NFL has made it easier for PE firms to acquire stakes in major sports teams. Additionally, policies promoting the growth of women’s sports and eSports are creating new investment opportunities.

Yieldstreet’s Yarbrough estimates that returns on investing in professional sports teams on the equity side would be in the upper teens, while investments through debt could range from the upper single digits to low double digits. DBRS Morningstar found that while the S&P 500 rose by 317% between 2004 and 2022, NBA’s valuation rose 1,079% over the same time period, and MLB’s valuation rose by 702%. The only two periods in the past two decades when any of the major leagues lost money included the peak of the Global Financial Crisis in 2008-09 and the COVID-19 pandemic. “If you are thinking about the long-term prospects of it, what better place to consider than an asset class that for the last 15 years has been on an up trajectory?” said Scott, who used to play for the NFL’s Arizona Cardinals. “It’s an area that most people haven’t had access to, so given that, that comes with a potential higher return to consider.” And what a lot of people don’t understand is when you own a team in a league in North America, you own a pro-rated share of the entire league. So, if you own an NBA franchise, whether you are in last place or in first place, you still get your dividend from the NBA from the profitability of the entire NBA,” he added. “That means you are going to get, depending on the year, millions of dollars without ever potentially even winning a game.”

The convergence of disruption in the sports industry and new investment opportunities presents a unique and highly lucrative landscape for PE and VC firms. By understanding these trends and their implications, investors can strategically position themselves to capitalize on the evolving sports market. As the industry continues to grow and innovate, the potential for high returns and diverse investment opportunities remains vast, making it prime time to engage in sports investments.

The involvement of private equity firms in sports teams can bring significant financial resources and strategic expertise, potentially enhancing long-term sustainability and competitiveness. However, it also presents risks related to short-term financial focus, debt burdens, and competitive imbalances. The overall impact depends on how well teams and leagues manage these investments, balancing immediate financial returns with long-term developmental goals and maintaining strong fan and community relationships. Robust regulatory frameworks and strategic oversight are essential to maximize the benefits of private equity while mitigating potential drawbacks.

Danny Cortenraede is a global serial entrepreneur and investor. He is the founder of InStudio Ventures, based in Los Angeles, CA.

Recent Insights

The $826 Billion Game: Navigating Investment Opportunities in Sports

The sports industry is experiencing an unprecedented influx of institutional investors, private equity, and venture capital, driving a major shift in how sports franchises are financed and operated. JPMorgan Chase recently formed a dedicated sports investment division led by Eric Menell and Gian Piero Sammartano, highlighting the growing attraction from institutional investors. Seasoned investment firm Sixth Street Partners recently announced a sports-focused fund and has already invested in Real Madrid, Barcelona, and Bay FC. Another major player is Arctos Partners, which has over $7 billion invested primarily in sports teams alone.

Private equity firms are becoming increasingly prevalent in the ownership structures of sports teams across major leagues such as the NBA, NHL, MLB, and MLS. This shift is driven by the soaring valuations of these teams, which now see NBA franchises averaging $4 billion in worth, MLB teams at $2.64 billion, and NHL teams at $1.31 billion (Sportico). The leagues have embraced private equity due to stringent ownership regulations that ensure control remains within the league’s framework. The remarkable growth in team values has made sports franchises a highly attractive investment, outpacing the stock market’s growth over the past thirty years. DBRS Morningstar found that while the S&P 500 rose by 317% between 2004 and 2022, NBA’s valuation rose 1,079% over the same time period, and MLB’s valuation rose by 702%. For private equity investors, the appeal lies not only in the high returns but also in the diversification benefits, as sports assets typically do not correlate with other types of investments.

Rising valuations and growing opportunities for media rights and sponsorships make professional sports teams an attractive bet, with investments in 63 North American teams totaling $243.8 billion. The NBA leads with 20 teams connected to private equity valued at $74.2 billion. Despite constraints on controlling interests, firms like Arctos Partners have achieved significant returns, with Fund I delivering an 86.7% net IRR by September 2023.

However, alongside these opportunities come significant challenges and risks. This convergence of industry disruption and new avenues for investing presents unique prospects for private equity and venture capital firms. We’re already seeing in real-time the remarkable shifts in this space. Here are some compelling developments worth considering.

Disruption in the Sports Industry

The sports industry is experiencing significant disruption, driven by technological advancements, globalization, and shifting consumer behaviors. The global sports market is projected to reach $826 billion by 2030, reflecting robust growth across various segments (Yahoo Finance). Additionally, the global sports betting market is expected to expand from $83.65 billion in 2022 to $182.12 billion by 2030, driven by technological advancements and increasing legalization, with a compound annual growth rate (CAGR) of 10.3% (Grand View Research). The sports tech market is projected to grow to $103 billion by 2030. Key factors driving this disruption include:

- Globalization: The expansion of sports into new markets, particularly in Asia and the Middle East, is creating vast new audiences and revenue streams. The NBA’s strategic push into China, for instance, has resulted in a massive fan base and significant revenues from broadcasting deals and merchandise sales. In the Middle East, the NBA has partnered with local entities to host games and establish academies, broadening its reach and influence (BCW) (SportsPro Media).

- Shifts in Consumer Behavior: Younger audiences are consuming sports differently, preferring digital and interactive experiences over traditional broadcasts. This includes the rising popularity of women’s sports, eSports, and digital streaming. Platforms like Twitch have transformed how fans watch and interact with sports content, driving significant viewership growth in eSports and other digital formats (Deloitte United States) (BCW).

- Technological Advancements: Innovations such as augmented reality (AR), virtual reality (VR), and data analytics are revolutionizing fan engagement and team performance. For example, AR applications now allow fans to experience live games with interactive features like player stats and virtual courtside seats, significantly enhancing the viewer experience (BCW).

High Growth Potential for PE and VC Firms

These disruptions are creating highly lucrative opportunities for PE and VC firms. The sports industry continues to attract significant investments for a few key reasons:

- Sustained Revenue Growth: Sports franchises and related businesses have historically delivered strong returns. The increasing value of media rights deals and the global appeal of sports ensure steady revenue streams. For instance, the average value of an NFL team has surged to $5.1 billion, driven by lucrative broadcasting agreements and sponsorship deals (SportsPro Media).

- Diverse Investment Opportunities: The sports industry offers a range of investment avenues, from owning teams and leagues to investing in sports tech startups and infrastructure projects. This diversity allows investors to spread their risk and tap into various growth areas within the industry (SportsPro Media) (Sportcal).

- Expanding Market Segments: Segments like women’s sports and eSports are experiencing rapid growth, attracting significant investment. GroupM’s commitment to double media investment in women’s sports by 2025 underscores the potential in this segment (Sportcal). Similarly, the sports betting market, expected to grow at a CAGR of 10.3% from 2022 to 2030, offers substantial opportunities for investors (Grand View Research). Major financial institutions are increasingly recognizing the potential in sports investments. For example, JPMorgan Chase recently formed a new sports investment division to capitalize on the growing market (Profluence). This move signals strong institutional confidence in the sector’s growth prospects. Additionally, notable PE firms like Sixth Street, Bluestone Equity Partners, and Avenue Capital have launched dedicated sports funds, reflecting a strategic shift towards sports investments (PE Hub) (Private Equity Insights).

A Global Perspective

From a global standpoint, the sports industry is thriving across multiple regions and leagues:

European Soccer: Clubs like Manchester United and Real Madrid are expanding their global footprint through strategic partnerships and sponsorships. Manchester United’s landmark deal with Chinese technology giant Alibaba enhances digital fan engagement in Asia. Real Madrid’s 5-year deal with the Middle Eastern airline Emirates leverages the airline’s extensive network to promote the club worldwide. The Soccer Champions Tour 2024 will feature top teams like AC Milan, Barcelona, Chelsea, Manchester City, and Real Madrid playing in various US cities, solidifying the presence of European soccer in North America.

Middle East NBA Expansion: The NBA’s activities in the Middle East, including preseason games and the establishment of basketball academies, are significantly expanding the league’s presence. This initiative not only builds a fan base but also attracts local sponsorship and media deals. We can expect more collaborations and expansion projects as the NBA aims to solidify its footprint in this emerging market.

China’s Basketball Market: The NBA’s long-term engagement in China has seen immense success. Partnerships with Chinese tech firms and broadcasting deals with platforms like Tencent have opened massive revenue streams, making China one of the NBA’s most lucrative markets. Expect to see continued growth in partnerships and digital engagement as the NBA leverages China’s massive consumer base (SF Chronicle).

NFL Valuations and Policy Shifts: In 2023, Josh Harris led a group that paid a record $6.05 billion for the Washington Commanders, highlighting the rising valuations of NFL teams. The challenge of raising such substantial capital has prompted the NFL to reconsider its stance on private equity investments. NFL Commissioner Roger Goodell indicated potential policy changes by the end of the year to address this growing interest.

While the opportunities in sports investments are substantial, they come with inherent risks and challenges:

Opportunities:

- Emerging Markets: Investing in emerging markets like Asia and Africa can yield high returns as these regions experience rapid growth in sports viewership and participation. The rising middle class in these regions is driving demand for premium sports content and experiences, creating new revenue opportunities. Additionally, the increasing digital penetration in these markets facilitates access to sports content, thereby expanding the potential audience base (BCW) (SportsPro Media).

- Growing Media Rights: The increasing value of media rights is driving substantial revenue growth in the sports industry. Recent multi-year media deals highlight this trend:

- The NFL secured an 11-year media rights agreement with major broadcasters including ESPN, CBS, Fox, and NBC, valued at over $100 billion.

- The NBA deal with ESPN totaling $24 billion will come to an end after the 2024-2025 season, with a new media rights agreement approaching $6 billion annually as the league aims to increase its number of media partners (Forbes).

- The English Premier League signed a six-year extension with NBC Sports worth approximately $2 billion, granting exclusive broadcast rights in the US (NBCSports).

Dangers:

- Market Volatility: Economic downturns and geopolitical tensions can significantly impact sports revenues, particularly in emerging markets. For instance, the recent economic slowdown in China has led to reduced consumer spending, including on sports and entertainment. According to the World Economic Forum, global economic growth is expected to decelerate to 2.6% next year.

- Geopolitical tensions, such as those in the Middle East and the ongoing war in Ukraine, further exacerbate market volatility. These tensions can lead to increased energy prices, disrupted supply chains, and reduced consumer confidence, all of which can negatively affect the sports industry. Investors need to be aware of these broader economic contexts and their potential impact on the sports sector. Diversification and investing in well-established franchises with strong revenue streams can help mitigate these risks (WEF).

- Regulatory Risks: Regulatory risks remain a significant challenge for investors in the sports industry. For example, the European Court of Justice (ECJ) ruled that UEFA and FIFA’s rules preventing new competitions like the ESL from being established were unlawful under European law. A Spanish court recently ordered FIFA and UEFA to halt opposition to the ESL ruling that these organizations engaged in anti-competitive behavior and abused their dominant position by preventing clubs from participating in the proposed new competition. This ruling opens renewed discussions about alternative league structures (ESPN). Leagues have also implemented stringent controls around private equity ownership to mitigate regulatory risks. No PE firm is allowed to be a controlling owner of any North American major league franchise, and in some cases, they are not even allowed to vote. Leagues require transparency regarding every investor in the PE fund, allowing them to veto any undesirable deals. Additionally, the sale of a PE firm’s ownership stake usually needs league approval (Sportico). The regulatory landscape across the board remains complex and can impact investment decisions.

Challenges:

- Valuation Accuracy: Accurately valuing sports assets can be complex due to fluctuating team performance and changing market conditions. The recent debate over the valuation of sports franchises like the Dallas Cowboys illustrates this challenge. Some industry experts argue that the Cowboys’ $9 billion valuation is inflated due to brand value and potential future earnings, while others point to the franchise’s consistent financial performance and market dominance as justifying the high valuation. This debate underscores the complexities involved in sports asset valuation and the differing perspectives on future profitability (Sportcal).

- Management and Control: PE and VC firms often face challenges in managing sports assets effectively, balancing profitability with the unique cultural aspects of sports organizations. The example of private equity’s involvement in Formula 1 shows how management complexities can arise, particularly in balancing commercial interests with the sport’s traditional values and fan expectations (SportsPro Media). To navigate these challenges, investors should prioritize strong governance structures and align management strategies with the cultural and operational realities of sports organizations.

New Shifts in Policy and Parameters

Recent shifts in policy and regulatory parameters are also influencing the investment landscape. The ongoing movement around opening up ownership rules in leagues like the NFL has made it easier for PE firms to acquire stakes in major sports teams. Additionally, policies promoting the growth of women’s sports and eSports are creating new investment opportunities.

Yieldstreet’s Yarbrough estimates that returns on investing in professional sports teams on the equity side would be in the upper teens, while investments through debt could range from the upper single digits to low double digits. DBRS Morningstar found that while the S&P 500 rose by 317% between 2004 and 2022, NBA’s valuation rose 1,079% over the same time period, and MLB’s valuation rose by 702%. The only two periods in the past two decades when any of the major leagues lost money included the peak of the Global Financial Crisis in 2008-09 and the COVID-19 pandemic. “If you are thinking about the long-term prospects of it, what better place to consider than an asset class that for the last 15 years has been on an up trajectory?” said Scott, who used to play for the NFL’s Arizona Cardinals. “It’s an area that most people haven’t had access to, so given that, that comes with a potential higher return to consider.” And what a lot of people don’t understand is when you own a team in a league in North America, you own a pro-rated share of the entire league. So, if you own an NBA franchise, whether you are in last place or in first place, you still get your dividend from the NBA from the profitability of the entire NBA,” he added. “That means you are going to get, depending on the year, millions of dollars without ever potentially even winning a game.”

The convergence of disruption in the sports industry and new investment opportunities presents a unique and highly lucrative landscape for PE and VC firms. By understanding these trends and their implications, investors can strategically position themselves to capitalize on the evolving sports market. As the industry continues to grow and innovate, the potential for high returns and diverse investment opportunities remains vast, making it prime time to engage in sports investments.

The involvement of private equity firms in sports teams can bring significant financial resources and strategic expertise, potentially enhancing long-term sustainability and competitiveness. However, it also presents risks related to short-term financial focus, debt burdens, and competitive imbalances. The overall impact depends on how well teams and leagues manage these investments, balancing immediate financial returns with long-term developmental goals and maintaining strong fan and community relationships. Robust regulatory frameworks and strategic oversight are essential to maximize the benefits of private equity while mitigating potential drawbacks.

Danny Cortenraede is a global serial entrepreneur and investor. He is the founder of InStudio Ventures, based in Los Angeles, CA.

Recent Insights